Throughout October and November, people can access an affordable will-writing service while donating to vital patient care at Dr Kershaw’s Hospice.

Wrigley Claydon Solicitors, O’Donnell Solicitors, Garratts Solicitors and Kirkham Legal are all taking part in Will Month to highlight the importance of having a will.

Dr Kershaw’s Hospice has partnered with trusted local solicitor firms to help people in Oldham ensure that their last wishes are granted.

This autumn, people can access a reduced-fee will-writing service as part of Will Month. Wrigley Claydon Solicitors, O’Donnell Solicitors and Garratts Solicitors are all taking part in October.

Kirkham Legal will then provide the service throughout November. In return for a suggested donation, people can write or update their will.

It costs £125 for a Simple Individual Will or £175 for a Simple Mirror Will for a couple, representing a significant saving.

There is also the option to include Dr Kershaw’s Hospice in the will to provide future care for patients and their families.

Rachel Damianou, partner at Wrigley Claydon Solicitors, said: “Making a will during Will Month is an excellent way of making everything easier for your loved ones when the time comes, whilst also supporting a really worthwhile cause.

“Accidents and illness can sadly happen at any time.

“It is always best to be prepared and it is never too early to make a will.”

People with children may particularly benefit from putting a will in place.

Under law, there is no presumption that a child must live with a biological parent after the death of the other. If both parents die without a will naming a guardian, the bereaved child becomes the responsibility of the courts.

Rachel added: “A will can appoint guardians to look after young children and ensure your wishes are followed, rather than the courts and the law stepping in to say who should look after your children.”

According to the Money & Pensions Service, around 56 per cent of UK adults do not have a will. This includes 53 per cent of adults aged 50-64 and 22 per cent of those aged 65 and above.

Without a will, assets are at risk of being shared out by legal default, rather than in the way people choose.

Unmarried couples – including those who live together – have no automatic legal rights to inheritance from their partner’s estate.

Even married couples cannot guarantee how their estate will be shared without a will.

Jill Latimer, solicitor at Garratts Solicitors, said: “There is a common misconception that assets will automatically go to the ‘next of kin’ upon death.

“Unfortunately, that is not always the case.

“If you do not have a valid will, intestacy laws can determine how your estate is handled and this may not align with your intentions.

“If you are married but do not have a will, your entire estate may not pass to your surviving spouse.

“Similarly, if you are not married, your estate will not automatically go to your partner, regardless of how long you have been together.

“Even if you have an existing will, it is always worthwhile reviewing it to take any changes into account.

“This could include additional children or grandchildren, protecting assets from potential care fees, or even being lucky enough to win on the Dr Kershaw’s Lottery!”

For more information or to take part in Will Month, visit www.drkh.org.uk/willmonth.

Derker community group recognised for support of Vulcan partnership work

Derker community group recognised for support of Vulcan partnership work

Second man arrested in connection with Manchester Mosque incident with local councillors expressing shock

Second man arrested in connection with Manchester Mosque incident with local councillors expressing shock

Council pushed to do more to support residents without internet access

Council pushed to do more to support residents without internet access

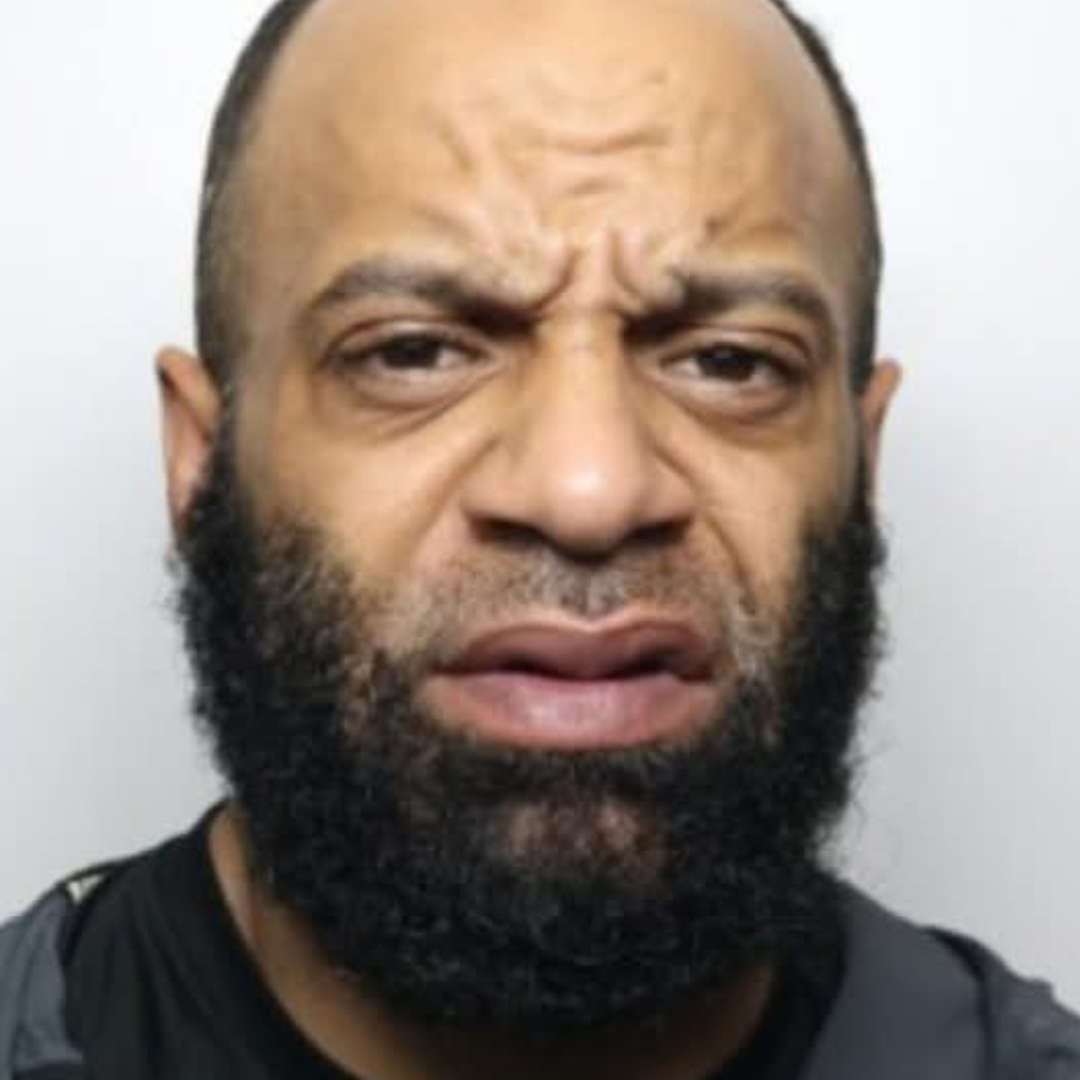

Man wanted on recall to prison

Man wanted on recall to prison